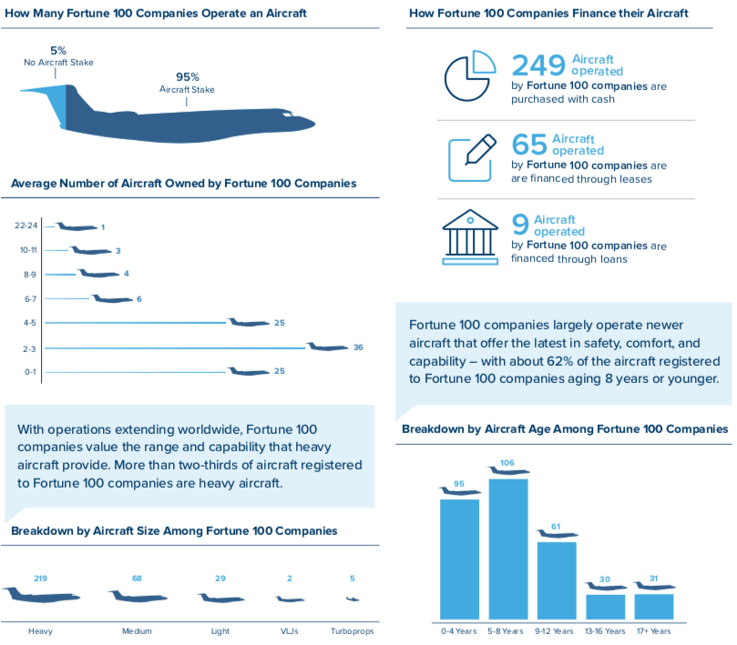

Business aircraft are an invaluable tool for the top global businesses. Public records indicate that at least 95% of the Fortune 100 top businesses utilize business aviation.

There are at least 323 aircraft registered publicly to the Fortune 100 companies, with the median company owning 3 aircraft.

Financing plays a major role in companies’ aircraft ownership – more than one-in-five aircraft have a lease or loan attached to it.

With over $2.6B in assets under management, Global Jet Capital specializes in financial solutions for the business aircraft market.

With over $2.6B in assets under management, Global Jet Capital specializes in financial solutions for the business aircraft market.The company is capitalized by world-class private investors with expertise in the global aviation industry: The Carlyle Group, AE Industrial Partners, and FS / KKR Advisor, LLC, a partnership between FS Investments and KKR Credit.

Capitalized by three global investment firms, and managed by a team of industry veterans, Global Jet Capital has been committed from day 1 to providing a full range of customized financing solutions solely for business aviation. This, combined with our unparalleled asset management expertise, allows us to offer clients flexible lifecycle solutions to fit their individual and changing aviation and financial requirements.

With more than two hundred years of collective experience and thousands of aircraft transactions behind us, we are uniquely qualified to do what we do. Get in touch today to learn how Global Jet Capital can help you and your business.